Building a Popular Mobile Wallet App – 12 Essential Features

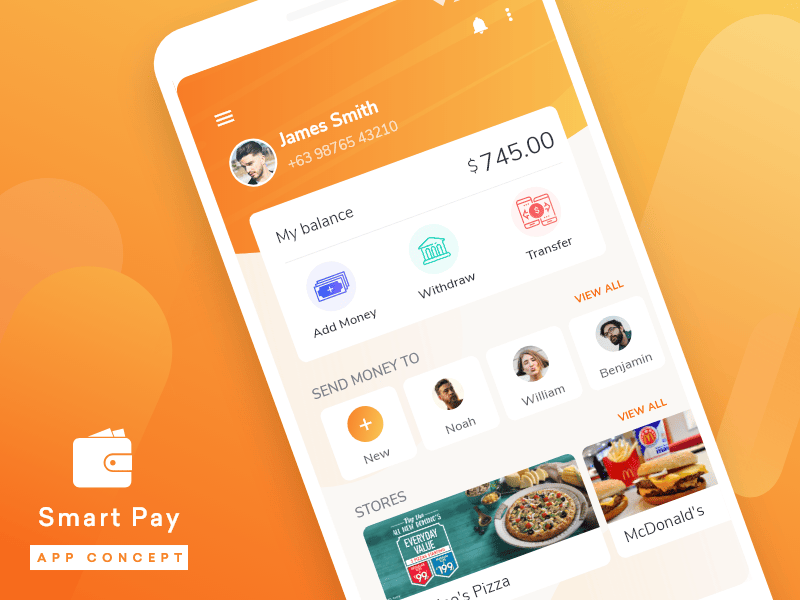

Banks, financial companies, telcos, and e-commerce businesses can’t ignore the mobile financial services onslaught any longer, especially mobile wallets. The need of the hour is tor a mobile wallet app that ensures not only high security but also great customer experience. People love a fuss-free and quick transaction. When it comes to wallet app development here are the essential features to keep in mind while building a popular mobile wallet app.

Today, people would like to stop reaching for their physical wallets every time they need to make a transaction. It only seems convenient to use a mobile payment app when you’re transacting, instead of reaching for your card or cash all the time. Given that we spend so much time on our smartphones, a peer to peer payment app may be the best way to send or receive money going forward.

Well, it’s not only individuals. Banks, financial companies, telcos, and e-commerce businesses can’t ignore the mobile financial services onslaught any longer, especially mobile wallets. The need of the hour is tor a mobile wallet app that ensures not only high security but also great customer experience. People love a fuss-free and quick transaction. When it comes to wallet app development here are the essential features to keep in mind while building a popular mobile wallet app.

Get the Best Updates on SaaS, Tech, and AI

Instant payment and money transfer

The money transfer between the payer and payee wallet must happen within seconds, instead of hours or business days. This feature is beneficial because it allows payments anytime and anywhere, and makes funds immediately available. In our increasingly cashless society, instant payments are inevitable.

Bank account seamless links

An ideal digital wallet solution should allow seamless money transfer to any bank account, including your own accounts in the same bank, as well as transfer to another person’s bank account in a different bank. Ideally, mobile wallet users should have a lot of options for sending and receiving personal or business money with just a few taps on their phone, wherever and whenever they need to.

Bill and utility payment integration

A good mobile wallet app needs to have bills and utilities integrated online, like electricity, mobile prepaid or post-paid, internet bill, etc. Since mobile wallets are increasingly becoming an integral part of daily life, they are even branching out into other services like booking flight tickets and movie tickets online to name a few.

Physical and virtual card operation management

A good digital wallet should be able to store a user’s debit/credit card data, so that transactions may be made at any time. This way, a mobile wallet simplifies a user’s finances conveniently, by clubbing all their cards in one central space. A mobile wallet is also a safer bet than carrying all your cards with you because of store card numbers. Card data is instead encrypted with high-grade security. What’s more. Today people also have a range of loyalty cards. A good mobile wallet app needs to be ready to manage multiple card operations like blocking and unblocking, pin change, spending limit changes and applications for new cards.

Contactless technology (NFC or QR code scanning)

Payments using mobile wallets can be made via contactless methods like near-field communication (NFC) and QR code. NFC is a contactless remote technology that relies on a close distance (up to 10 cm) and provides people with secure payment between POS devices and smartphones. A QR code works like a barcode but is scanned with a smartphone, which interprets it and opens the related application or website.

Security

When it comes to mobile wallet applications, security comes first. Money transactions need to be safe from end to end. When it comes to mobile wallet security, there are plenty of technologies like point-to-point encryption, tokenization, passwords, biometrics, out-of-band authentication, one-time password via SMS, and security questions.

Easy registration

Generally, users should be able to download the app and run it. Then they need to sign up by providing details like their name, email ID, phone number, etc. Then they need to confirm their registration via an OTP. Next, they need to set up their password and log in. Finally, they link their debit and credit card, add money and start using the wallet. A smooth registration is vital for attracting and keeping users.

Loyalty points, coupons, discounts

Well, it is well-known that people love rebates. Mobile wallet apps are the best environment to provide deal-seeking consumers with these benefits. Provide consumers with enough reason to stay on your app, and they will.

Cash withdrawals and deposits at the bank branch or ATM

Holders of mobile wallet apps may make an ATM withdrawal without using a physical debit card. For ATMs, NFC technology is used. This is the same contactless technology that lets users pay by tapping their smartphone against a POS terminal.

Assistance chatbot

A chatbot for a mobile wallet app would be an ideal way to communicate with users, to keep them engaged and to improve customer service. Implementing a chatbot into a digital wallet app allows your services to be available 24/7 at a lower service cost. Consumers are always on the lookout for instant responses on any digital channel. Hence, chatbots may be a great addition to boost customer satisfaction by helping to answer their queries at any time.

Financial health tracking

Tracking your financial health over time is essential for every customer. We all need to be aware of our financial situation at all times. An analytical dashboard allows digital wallet holders to view and analyze their personal financial operations, through reports, diagrams, and figures. Personal financial management may give users all the information they need to make clear financial decisions of how, when and where they’re spending and receiving their money.

Budgeting and planning

A good mobile wallet app may help users plan their finances on the go. A good mobile wallet app needs to let users easily create budgets and make plans for spending wisely. A good mobile wallet app should allow users to set a budget for each category of expenses, create categories of expenses and income, set reminders when the budget is being exceeded, set reminders when bills are due, and set saving goals.

Thus, a good mobile wallet app needs to not only allow seamless transactions but also help the user become financially wiser, by helping them plan their spends and take stock of their income.

Nikunj Gundaniya, Product manager Digipay.guru, one of the leading digital wallet solutions, which provides mobile finance application development services. He is a visionary leader whose flamboyant management style has given profitable results for the company. He believes in the mantra of giving 100% to his work.

FTC Disclosure: The pages you visit may have external affiliate links that may result in me getting a commission if you decide to buy the mentioned product. It gives a little encouragement to a smaller content creator like myself.

3 responses to “Building a Popular Mobile Wallet App – 12 Essential Features”

All e-wallets have specific algorithms of encrypting sensitive data, such as your name, bank account information, credit card number, etc. Nobody sees this information, because even during the transaction a unique code is generated and personal data is not used..

I’m seeing an increase in mobile wallet app for my country on the google play store and I use quite a few of them. Guess I will now have to be cautions of these features while using these apps onward.

On an off topic…

Your blog looks gorgeous, what theme are you using for your website, if you don’t mind. =)

Hi Emmanuel, thanks for your comment. Sorry for the late reply. Here in Malaysia, we have more than 8 major e-wallet players.

In another note: I am using the GeneratePress theme, the fastest and more efficient WordPress theme (tested by myself between many other themes).